How much can you borrow based on income

This ratio says that. If you make 70000 a year your monthly take-home.

A Home Of Your Own Home Buying Living Room Accessories Living Room Theaters

While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643.

:max_bytes(150000):strip_icc()/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)

. However this might not be the amount you can borrow. There are three parts to this calculator. 29 for down payments of less than 20 and 30 for down payments of 20 or more.

A 250000 home with a 5 interest rate for. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. But ultimately its down to the individual lender to decide.

Heres a quick rundown of some of the things that lenders will take into account when determining how much you can qualify for. The calculator will ask you to provide all your income streams including your. The VA loan affordability calculator is.

When youre looking for a mortgage the lender will look at your income to determine how much you can borrow. What a How Much Can I Borrow calculator does The NerdWallet How much can I borrow mortgage calculator utilizes an easy step-by-step process. Thats a 120000 to 150000 mortgage at 60000.

Ad Low Interest Loans. Lock Your Mortgage Rate Today. Ad Well Help Build The Financial Plan And Investment Strategy You Need Based On Your Goals.

Personal Loans 2022 Low Interest Top Lenders Comparison Free Online Offers. 9000000 and 15000000. Use the calculator above to determine the income you need to purchase a 300000 home.

As part of an. Annual income monthly expenses and loan details. How much do I need to make for a 250000 house.

How much you can borrow is based on your debt-to. Mortgage lenders in the UK. You need to make 138431 a year to afford a 450k mortgage.

Mortgage Calculator This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income. This mortgage calculator will show how much you can afford. The following housing ratios are used for conservative results.

Learn More From One of Our Trusted Financial Advisors Today. These days most lenders limit borrowers to a. Our calculator uses information from you about your income monthly expenses and loan term to calculate an estimate of what you may be able to afford.

The loan-to-value is how much you actually borrow as a percentage of the value of your house. Get The Service You Deserve With The Mortgage Lender You Trust. In as much as borrowing money is difficult with a small paycheck there are.

This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. Fill in the entry fields. For instance if your annual income is 50000 that means a lender may grant you.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Get The Service You Deserve With The Mortgage Lender You Trust. You may have to pay an early repayment charge to your existing lender if you remortgage.

Ad Work with One of Our Specialists to Save You More Money Today. According to Brown you should spend between 28 to 36 of your take-home income on your housing payment. Generally lend between 3 to 45 times an individuals annual income.

When you apply for a mortgage lenders calculate how much theyll lend based on both your. Answer 1 of 4. For this reason our calculator uses your.

Get Your Estimate Today. We calculate this based on a simple income multiple but in reality its much more complex. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

2022s Best Home Equity Loans Comparison. This is probably the most. Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford.

Based on your current income details you will be able to borrow between. Lock Your Mortgage Rate Today. Our mortgage calculator can give you a good indication of the amount you could borrow.

This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. Find out how much you could borrow. Ad Were Americas Largest Mortgage Lender.

Your home may be repossessed if you do not keep up repayments on your mortgage. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Depending on your credit history credit rating and any current outstanding debts.

Get Your Estimate Today. Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match. A debt ratio of 36 is used for all.

It is essential to know that you can have a fallback plan in case of an unforeseen financial crisis. Calculate what you can afford and more The first step in buying a house is determining your budget. How much you can borrow is based on your debt-to-income ratio.

Skip The Bank Save. Ad Were Americas Largest Mortgage Lender.

:max_bytes(150000):strip_icc()/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)

Subsidized Vs Unsubsidized Student Loans Which Is Best

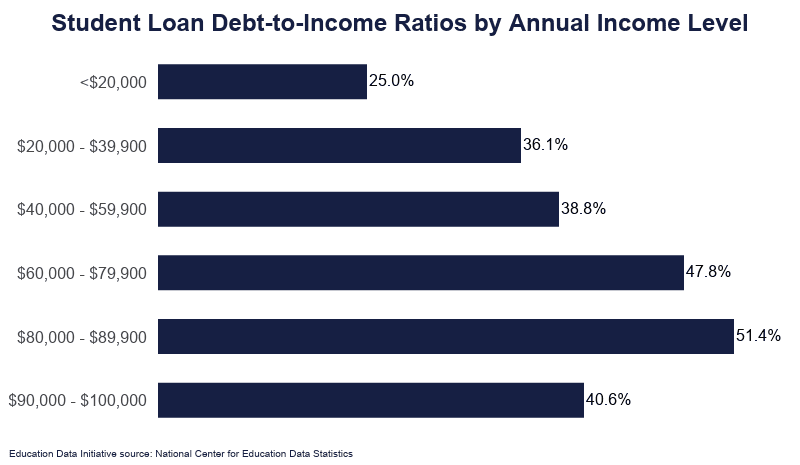

Student Loan Debt By Income Level 2022 Data Analysis

See If Your Income Is Sufficient To Qualify Www Doubleamortgage Com Real Estate Tips Real Estate Houses Mortgage

Are Payday Loans Quick To Process Infographic Business Finance Payday Loans Payday Payday Loans Online

Primelending S Home Affordability Calculator Can Help With Setting A Price Range Based On Your Income Debt Down Credit Score How To Plan Mortgage Calculator

Real Estate Infographic On Prequalification Vs Preapproval Real Estate Infographic Real Estate Tips Real Estate Investing

How Likely Do You Think You Are To Get Out Of Default And Repay Your Loans Pie Chart Student Loans Federal Student Loans Student Loan Consolidation

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

How Much House Can I Afford Infographic Buying First Home Buying Your First Home Home Buying Tips

Unchained Freeing Myself From Student Loans Student Loans Student College Debt

/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)

Subsidized Vs Unsubsidized Student Loans Which Is Best

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Pin On Information

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage

How To Calculate Gross Income Per Month

Prjije5rjguwlm

Mortgage Due Diligence Services Mortgage Underwriting Credit Rating Agency